If you’re new to all things credit related or have only just started building a credit history, you may be wondering how your credit score can affect your financial life. There are so many benefits to having a better credit score and one of the main benefits is that you can get accepted for credit more easily and it can also save you money too! In the blog below we look at why your credit score is so important and also how to easily increase your credit score if you’ve never had credit or have mishandled payments in the past.

Table of Contents

What is a Credit Score?

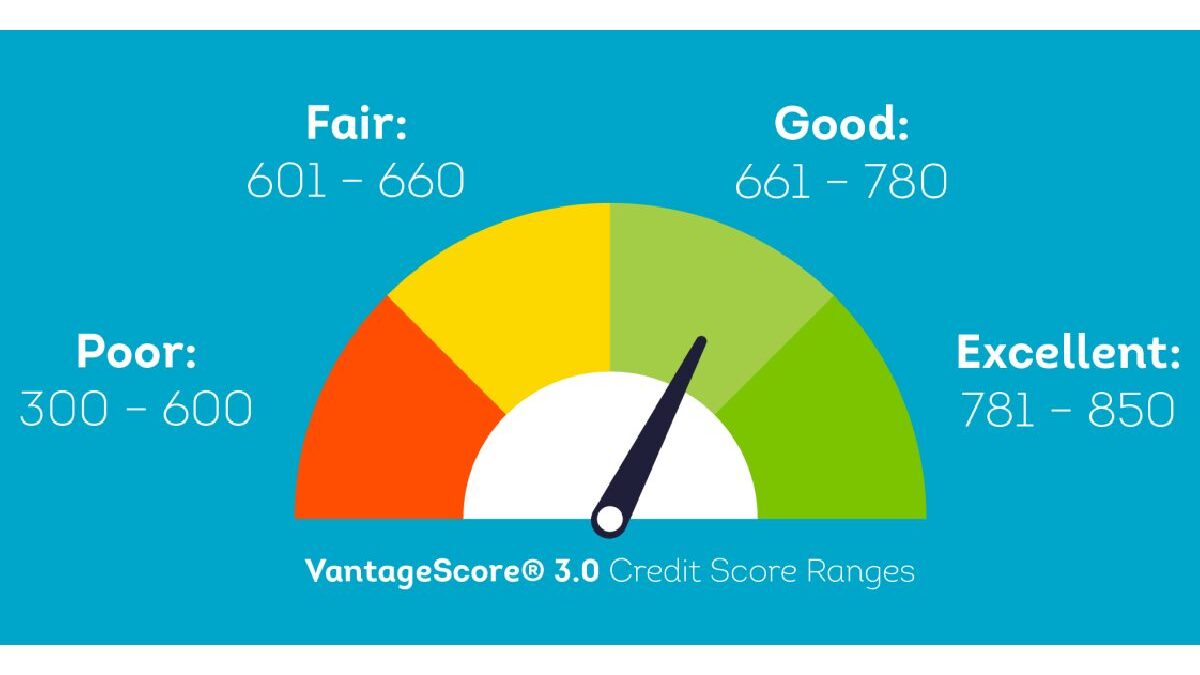

Your credit score is essentially a reflection of how well you’re able to manage finance or credit. A bad credit score usually indicates that you’ve missed payments in the past, made late repayments or have high levels of credit and debt. People with good or excellent credit scores usually have a long history of making payments on time and in full, manage their credit responsibly and keep their credit utilisation low. Depending on which credit referencing agency you use, your credit score can vary as each individual company uses their own scoring system. However, they tend to all have the same perspective when it comes to credit.

What are the Top Benefits of Having a Better Credit Score?

There are so many benefits to having a good credit score, but the main advantages are clear.

1. Pay less interest

When you apply for things such as car finance or mortgages, you will usually have to undergo a credit check whilst it can be possible to get no credit check car finance, you should be wary of companies offering these services as they usually set sky high interest rates to secure the deal. A better credit score means you can get access to lower interest rates because due to your previous history you are less of a risk to lend to.

2. More negotiation power.

Having a better credit score can give you more negotiation power with your existing lenders and also future forms of financing. You can usually ask for higher credit limits and get access to multiple lenders when applying for mortgages or car finance and then choose the best rate.

3. Easier finance acceptances

When your credit score is better, you will usually find that it can be easier to get accepted for finance or credit. When your credit history is adverse or you have no credit history, lenders can predict how likely you are to pay your finance back on time or based on your previous history you’re more likely to default on your loans.

Easy Ways to Improve Your Credit Score:

If you’re looking to improve your credit score to reap the benefits of better financial management, it can take time. However there are a few easy suggestions to help improve your score over time.

Make payments on time and in full

To help show potential lenders that you can be trusted to stick to the rules of your credit agreement, you should try to keep on top of any payments or finance you currently owe. If you’re struggling to pay back your loans, you should speak with the lender who you owe and see how they can help. Missed or late repayment can stay on your credit report for a number of years and seriously affect your ability to borrow in the future.

Reduce existing debt

Where possible, you should try to reduce the amount of debt you owe to help clear your credit usage. The credit utilization ratio is using by lenders to see how much of your available credit you are using. Using all of your credit limit and struggling to bring it down can put future lenders off as they will assume you can’t handle any more loans or finance.

Build a small credit history

Many consumers assume that having no credit history is a good thing. However, lenders can’t know what type of borrower you will be if you don’t have any evidence to go off. It can be better to have a small credit history that you manage responsibly rather than no credit at all. You can do this by doing something as easy as getting a mobile phone contract in your name and setting up a direct debit to take the payment each month on time and in full.

Check your credit report

The information listed on your credit report helps to calculate your credit score so it’s important that all your information is accurate and up to date. Having information listing on your credit report that is inaccurate can be negatively impacting your score. And if it doesn’t match with the info you put into a finance application, it can put lenders off as they may fear it’s a fraudulent application.

Avoid opening any new accounts

Whilst you’re trying to improve your credit score, it can be a good idea to not take on any new credit in this time. You can also be affected by how recent your credit accounts are and opening multiple accounts in a short space of time or making applications for finance can harm your credit score.